owe state taxes ny

Stepped-up basis primarily benefits the wealthiest families because they have the most unrealized capital gains. New York state taxes for gambling winnings.

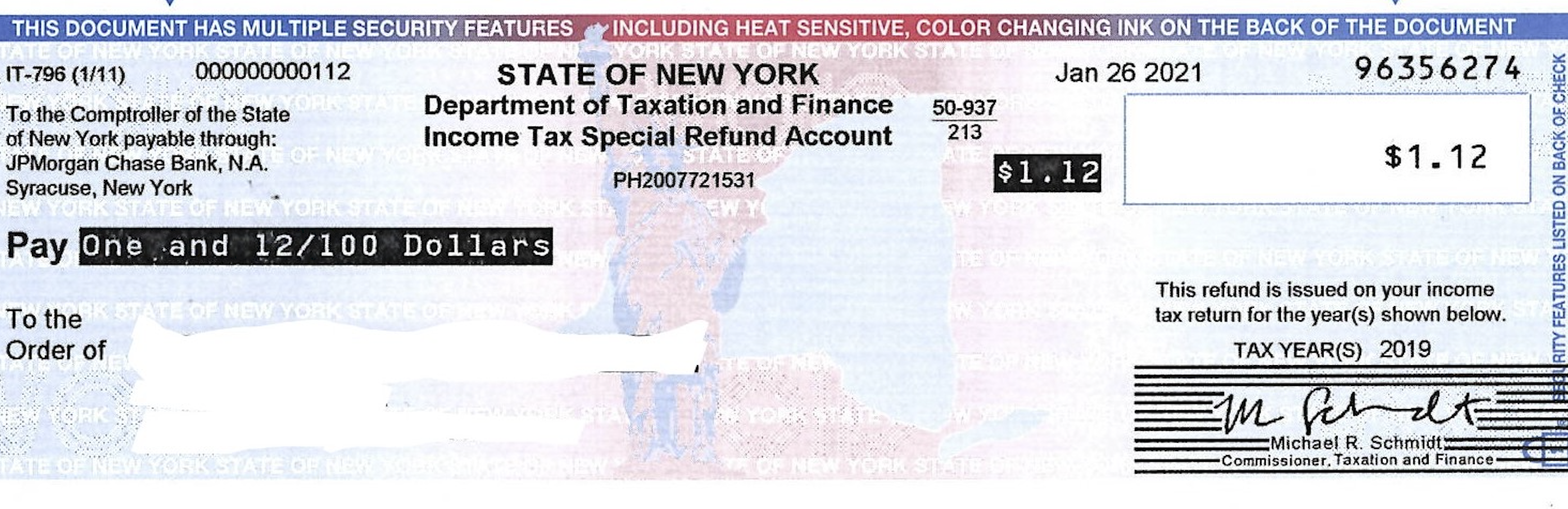

Ny Sends Tiny Checks To Pay Interest On Last Year S Tax Refund Syracuse Com

4 00 4 00 5Alimony received.

. Additionally your place of employment will withhold state and local taxes for the work state. 112002210094 IT-112-R 2021 back Part 2 Computing your resident credit for taxes paid to another state local government or the District of Columbia 23 Enter the two-letter abbreviation of the other state including the. The numbers above are only an estimate of the tax you will owe if the tax rate remains the same.

Just like the IRS the state of New York considers most of your gambling winnings taxable income. Now that youve taken care of your federal responsibility its time to move onto your state obligations. However what happens if you file taxes lateor not at allis very different for those with an outstanding tax liability.

100 of the tax shown on your 2020 return 110 of that amount if you are not a farmer or a fisherman and the New York adjusted gross income NYAGI or net earnings from self-employment allocated to the MCTD shown on that return is more than 150000 75000 if married filing separately for 2021. Calculating the Taxable Value A propertys annual property tax bill is calculated by multiplying the taxable value with the tax rate. But most states no longer have an estate tax and the tax thresholds in states that do have the tax are generally so high that very few estates owe it.

2 min read Jan 04 2022. You must have filed a return for 2020 and it must have. Software updates and optional online features require internet.

State estate taxes used to help compensate for stepped-up basis by taxing assets at the time they were inherited. New Yorkers face steep state taxes on unemployment benefits from 2020 By Morgan McKay City of Albany PUBLISHED 926 PM ET. E-file fees do not apply to New York state returns.

Estimate the propertys market value. Additional fees apply for e-filing state returns. However you will still owe taxes in your home state.

Savings and price comparison based on anticipated price increase. Savings and price comparison based on anticipated price increase. All features services support prices offers terms and conditions are subject to change without notice.

You owe taxes could result in late-filing penalties. The penalty for not filing taxes depends on whether you owe taxes to the IRS. All features services support prices offers terms and conditions are subject to change without notice.

Nonresident state taxes Applies if youre an employee who works in one state but lives in another. Income and sales tax rates Single and separate filers in New Jersey have seven tax rates while joint filers have eight. The Department of Finance determines the market value differently depending on they type of property you own.

New York has a graduated income tax. Also in the same way how much you may owe depends on your unique tax situation. If an agreement exists between the two states you will only.

E-file fees do not apply to New York state returns. US-based players pay federal taxes where the top rate is 37 percent in addition to state and local taxes which are much higher for some players than others. 4Taxable refunds credits or offsets of state and local income taxes.

According to IRSgov there is no penalty assessed on taxpayers who are due a return but do not file on time. New Jersey state taxes 2021. Additional fees apply for e-filing state returns.

You might benefit from a reciprocity agreement between the two states. Software updates and optional online features require internet.

Irs Installment Agreement Aurora Co 80011 Mmfinancial Org 866 487 5624 Tax Help Irs Taxes Tax Debt

Irs Installment Agreement Greensboro Nc Mm Financial Consulting Inc Greensboro Internal Revenue Service Irs

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York City Taxes A Quick Primer For Businesses

Where S My New York Ny State Tax Refund Ny Tax Bracket

Nysdtf Infographic National Tax Security Awareness Week Infographic Tax Help Awareness

New York Tax Rates Going Up With A Twist Hodgson Russ Noonan S Notes Blog