springfield mo sales tax rate 2020

The Missouri sales tax rate is currently. Higher sales tax than 61 of Missouri localities 15 lower than the maximum sales tax in MO The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175.

4344 E University St Springfield Mo 65809 Realtor Com

Interactive Tax Map Unlimited Use.

. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax. The state sales tax rate in Missouri is 4225. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

The new tax will start on april 1st. Statewide salesuse tax rates for the period beginning January 2020. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

The minimum combined 2022 sales tax rate for Republic Missouri is. The base sales tax rate is 81. Missouri has recent rate changes Wed Jul 01 2020.

Missouri Sales Tax Rates By City County 2022. SalesUse Tax Rate Tables. The current total local sales tax rate in Springfield MO is 8100.

Statewide salesuse tax rates for the period beginning February 2020. The County sales tax. The County sales tax.

The minimum combined 2022 sales tax rate for Springfield Missouri is. Missouris sales tax rates for commonly exempted items are as follows. The December 2020 total local sales tax rate was also 8100.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Missouri Department of Revenue 2020 View sales tax rates in other Missouri cities Springfield Property. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

Section 144014 RSMo provides a reduced tax rate for certain food sales. The December 2020 total local sales tax rate was also 8100. The City heavily relies on sales tax revenues as its main source of revenue to fund vital services such as police and fire operations.

This is the total of state county and city sales tax rates. The December 2020 total local sales tax. With local taxes the total sales tax rate is between 4225 and 10350.

Sales Tax Revenue FY 2020 Budget FY19 Actual FY20 Actual 13301 Year-to-date sales tax revenues are up 01 compared to budget through May 2020 The City of Springelds May. Raised from 6225 to 8725. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

The Missouri sales tax rate is currently. This is the total of state county and city sales tax rates. 012020 - 032020 - PDF.

Actual rates are often much higher in. The city sales tax rate of 2125 includes a 1. This is the total of state county and city.

Springfield Sales Tax Total 8100 State 4225 County 1750 City 2125 Source.

Springfield Leaders Consider Expanding City Limits Kolr Ozarksfirst Com

Costco Opens In Springfield Mo

Sales Tax On Grocery Items Taxjar

Used Cars In Springfield Mo Used Cadillac Dealer

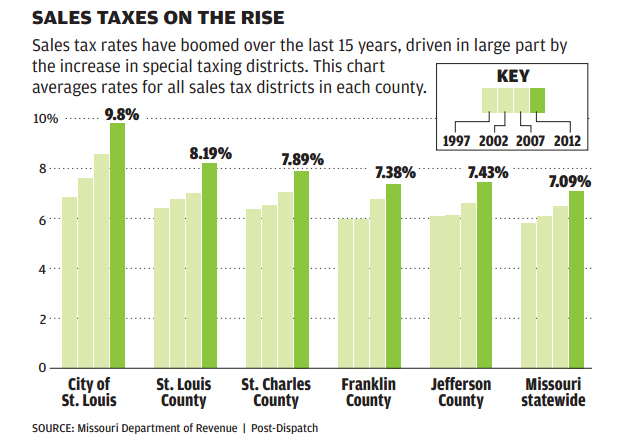

Sales Taxes In St Louis Relentlessly On The Rise

Survey Finds Missouri Land Values Increased Across The Board In 2021 Mu Extension

Historical Missouri Tax Policy Information Ballotpedia

Missouri Sales Tax Small Business Guide Truic

Taxes Springfield Regional Economic Partnership

What Fees Do I Need To Register A Vehicle In Missouri

Sales Taxes In The United States Wikipedia

Property Taxes By State How High Are Property Taxes In Your State

Michigan Sales Tax Guide For Businesses

Missouri Car Sales Tax Calculator

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

News Flash Springfield Mo Civicengage

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders